Fraud Transaction Monitoring

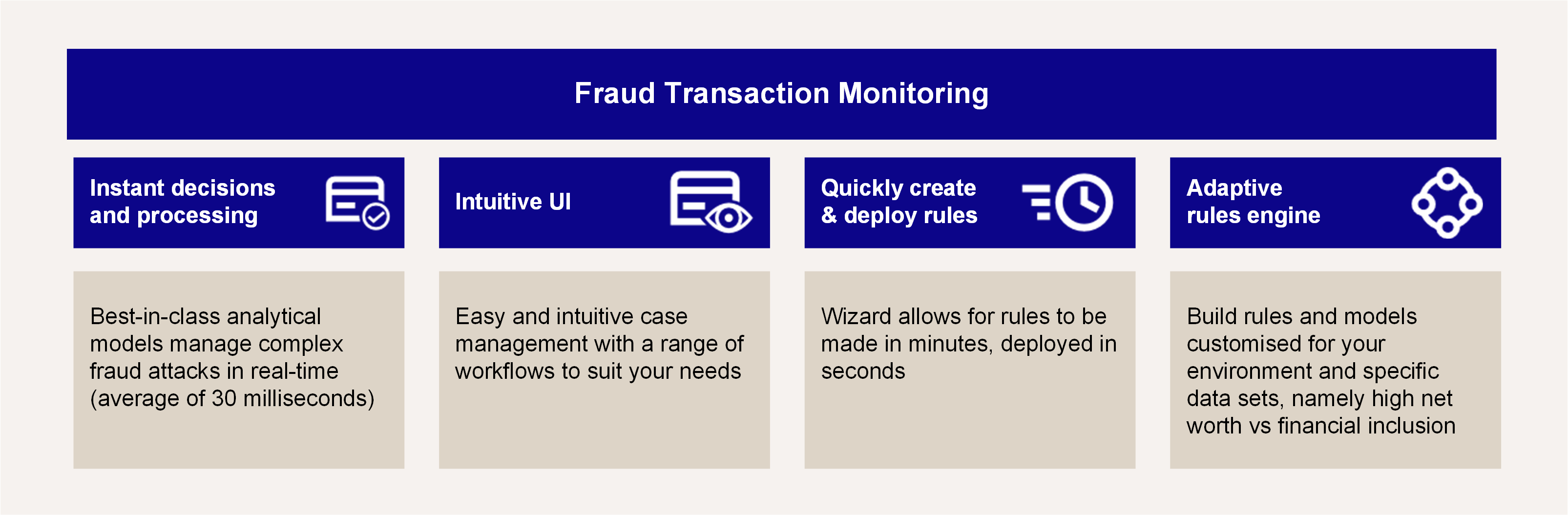

Going live with a card program requires a fraud monitoring solution with sophisticated detection models that query large sets of data over a period of time. The Fraud Transaction Monitoring system (powered by Featurespace) is a best-in-class, flexible card fraud solution that minimises online and offline card risk and offers real-time detection of card fraud.

Using adaptive behavioural analytics and machine learning, Enhanced Fraud Transaction Monitoring adapts to new fraud types and identifies unknown threats by detecting unexpected changes (anomalies) in real-time data. This improves transaction monitoring, identifies fraud and reduces the number of occurrences where legitimate transactions are flagged as suspicious, payments are stopped or accounts locked.

How it Works

Fraud Transaction Monitoring uses behavioural analytics to detect and prevent fraud with machine learning software that monitors individuals' behaviour and detects anomalies to identify risk and prevent fraud attacks in real-time.

We’ll start you off with a set of rules that we’ve tried and tested. These rules will protect your business from most fraud attacks. Best-in-class analytical models manage complex fraud attacks in real time (average of 30 milliseconds).

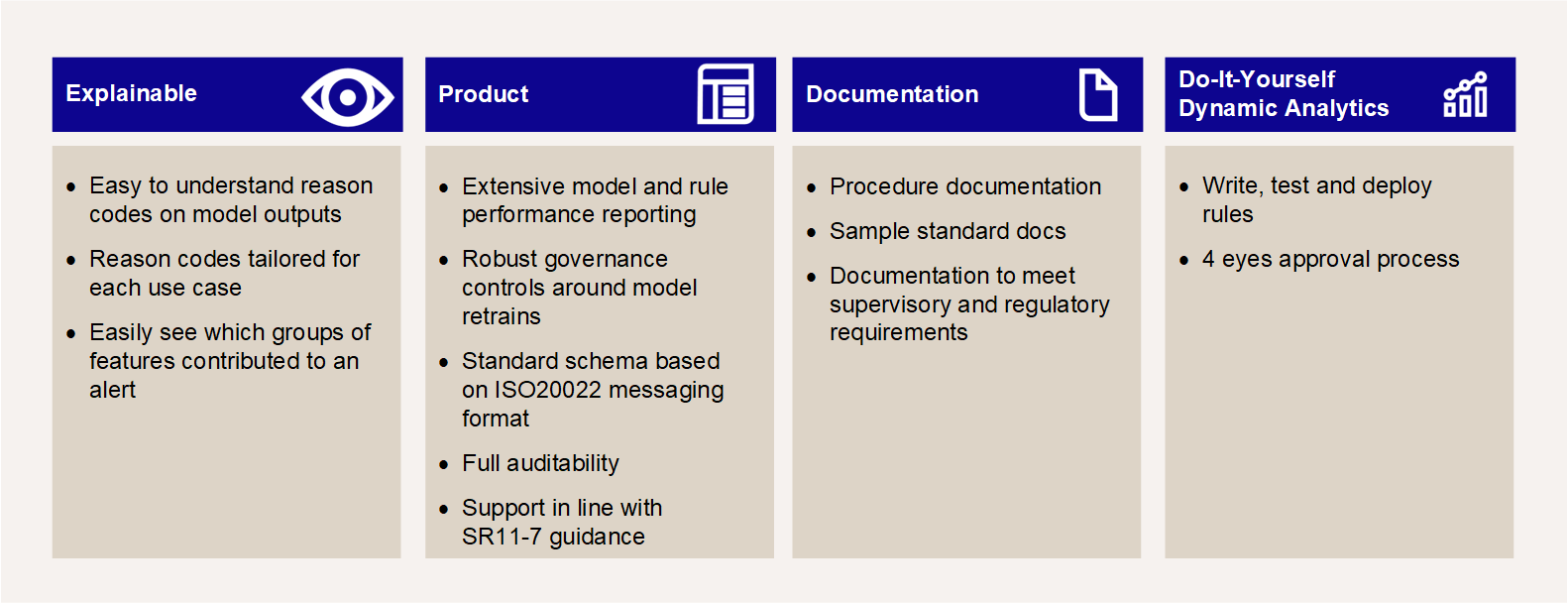

You can customise the Do-It-Yourself dynamic analytics by adjusting the model alert thresholds, writing, testing and deploying rules. We also provide a sandbox environment for your testing against historical and production data.

The adaptive rules engine deploys adaptive behavioural analytics in real-time for sophisticated evolving rules to be authored and configured by your risk analysts.

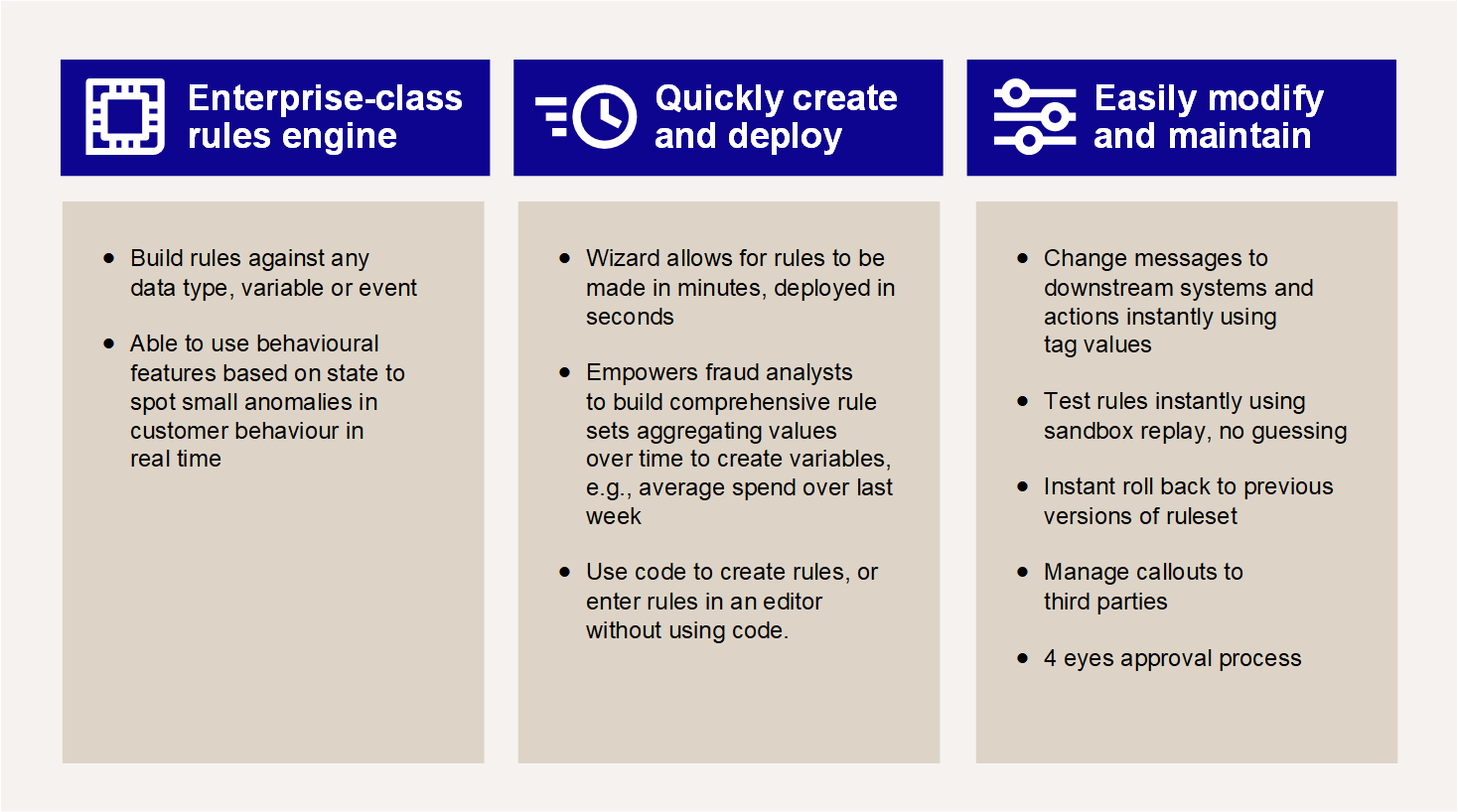

The enterprise-class rules engine builds rules against any data type, variable or event and is able to use behavioural features based on state to spot small anomalies in customer behaviour in real-time. It uses the analytical work-flow manager to build complicated nested rules.

Rules are created in minutes and deployed in seconds. Your fraud analysts can build comprehensive rule sets aggregating values over time to create variables, for example the average spend over the previous week. Using code to create rules, the rule editor enables rule creation without having to manually create code. For easy modification and maintenance, you can instantly change messages to downstream systems and actions, using tag values. You can also test the rules instantly using sandbox reply and immediately roll back to previous versions of the rule set. For easy modification and maintenance, you can instantly change messages to downstream systems and actions, using tag values. You can also test the rules instantly using Sandbox Replay and immediately roll back to previous versions of the rule set.

DocumentationFor more information on Fraud Transaction Monitoring , refer to the Fraud Transaction Monitoring Guides.

Updated 10 months ago